Buying a house with bad credit but large down payment

Applying with a co-applicant. Otherwise you need to be at 630 mid credit score.

Pin On Pinterest For Real Estate Marketing

FHA Loan Credit Score Requirements.

. The lender will want you to pay off any outstanding collections and judgments. Putting more money down means you have more skin in the game and the lender is risking less money. Providing a large down payment.

In as few as 30 days youll start to see. If your debt-to-income ratio is. Make a Big Down Payment.

There are also several types of home loans for those with bad credit including. Some people are under the mistaken impression that you must have good or even great credit in order to buy a house. If you would like.

If individuals cant get approved for conventional mortgages then FHA loans are the remaining option for hopeful homebuyers with bad credit. With a credit score from 500 to 579 youll need a down payment of at least 10 for an FHA loan. The first thing you must do if youre buying a home with bad credit and no down payment is prove you can make mortgage payments despite what your credit history.

Keep your credit utilization rate low. Paying off the mortgage sooner. Another terrific way to improve your credit score is to make on-time payments to your creditors.

When you have bad credit lenders typically require at least 1000 down or 10 percent of the vehicles selling price whichever is less. Thankfully lenders no longer. Applying for an FHA loan is the easiest way of buying a house with bad credit.

FHA loans may allow lower credit scores in the 500. That comes out to 80000 on a 400000 residence funds that very few buyers have. The standard down payment amount used to be 20 for home buyers.

However if your score is 500 to 579 be prepared to put 10 down. Typically the minimum credit score requirement for buying a house is between 500-620 depending on the type of loan. You can get an FHA loan with a credit score as low as 500.

FHA loan requirements are. A larger down payment means starting out with a smaller loan amount which has a few advantages. With so many loans and interest options the best thing to do is talk to a professional who can review your situation and.

Thatâ s truly not the case â there are plenty of. There are some loan programs that will allow your credit to be 580 or above with a sizeable down payment. Putting down more money can help you to pay off the mortgage loan sooner.

Your credit utilization rate is how much you currently owe divided by your. Rocket Mortgage is a name you probably know its Americas largest mortgage lender. Having a lower debt-to-income ratio.

Step-by-Step Guide for Buying a Home With Low Credit. If your credit score still falls into the bad or poor category when youre ready to buy a house rest assured you can likely still get a mortgage. Without this amount qualifying for a car.

Federal Housing Administration FHA Loan. Larger down payment. The agency approves borrowers with a credit.

Best For an Easy Online Process. Pay your bills on time every time. Potential disadvantages of making a larger down payment include.

One of these is that it creates a cushion of home equity even if housing. You should also keep your credit utilization ratio below 30. Whether youre a seasoned real.

Step By Step Guide To Buying A House Home Buying Tips Home Buying Process Home Buying

Security Check Required Home Buying Just Go Outdoor Decor

5 Ways First Time Homebuyers Ruin Their Credit Score And Their Odds Of Buying A House In 2022 Credit Score Home Buying Marketing Trends

Rent Vs Buy Figure Out What Option Is Best For You Rent Vs Buy Real Estate Agent Marketing Real Estate Infographic

A Down Payment On A House Doesn T Need To Be 20 Here S Why Los Angeles Times

8 Things Not To Do In Your Quest To Buy A House Infographic Home Buying Home Buying Tips Home Buying Process

How To Get A Mortgage 7 Steps To Success Forbes Advisor

14 Steps To Buying A House Real Estate Info Guide Home Buying Tips Buying First Home Home Buying

Pin Page

How Much Is A Down Payment On A House Do You Need 20 Percent Thestreet

Regranned From Makingdealsinheels 76 Mortgagetipmonday When Looking To Purchase A Home Your Credit Score Credit Score Loans For Bad Credit Mortgage Tips

Pin On Diy Tips

Pin By E Mortgage Finance Corp On E Mortgage Finance Corp Saving Money Buying Your First Home Rent

Does It Still Make Sense To Put Down 20 When Buying A Home Cnn Underscored

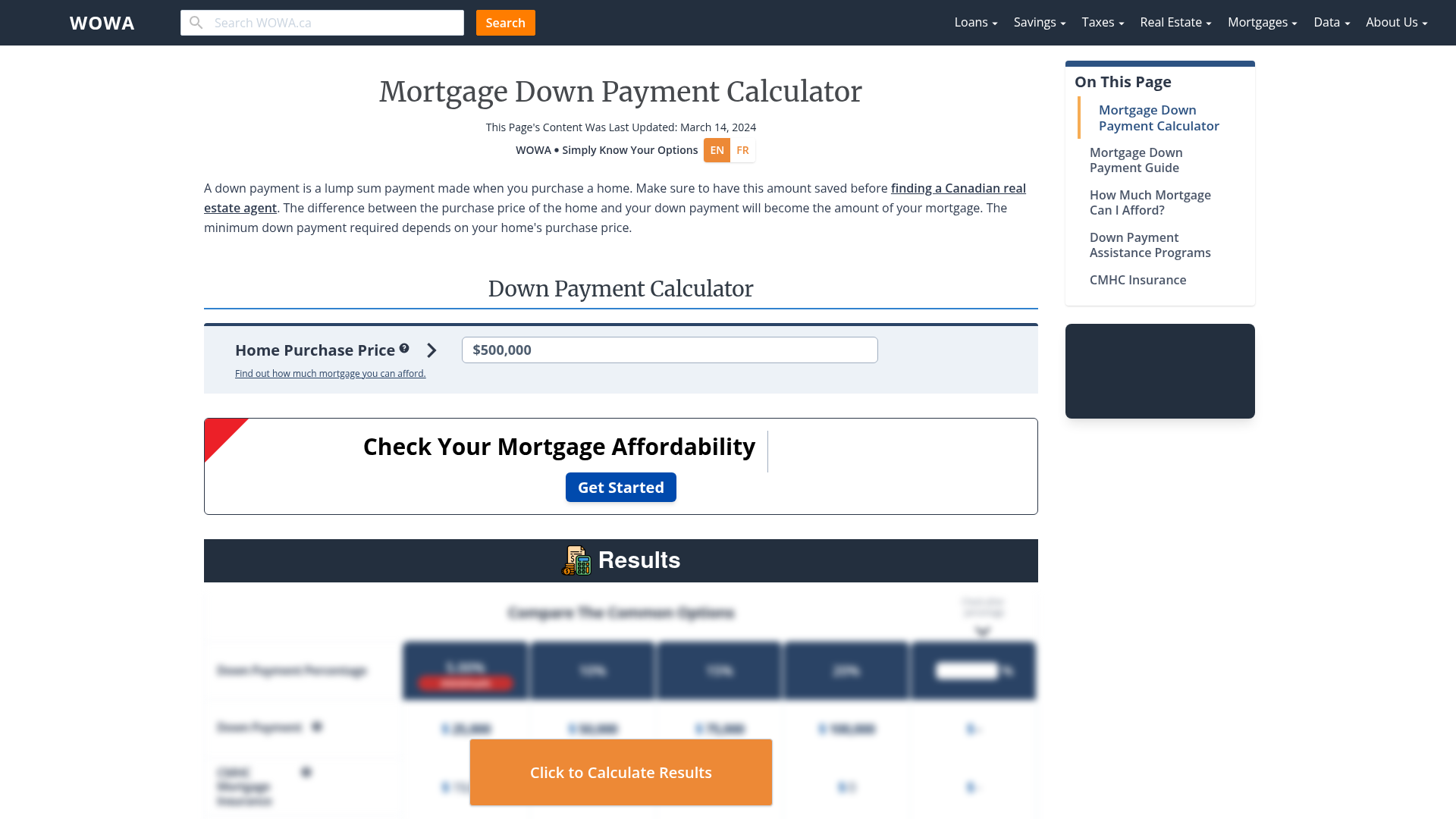

Mortgage Down Payment Calculator 2022 Mortgage Rules Wowa Ca

Friday 5 Unexpected Costs Buying A House Selling House Things To Sell Sale House

Mortgage Down Payment In Canada What You Need To Know In 2022